PAX Global Technology Limited (“PAX” or the “Group”, stock code: 00327.HK), one of the world’s leading providers of electronic payment terminal (“E-payment terminal”) solutions and related services, is pleased to announce its unaudited interim results for the six months ended 30 June 2024 (the “Period”).

In the first half of 2024, the global economic recovery remained sluggish amidst strong US dollar and high-interest rate environment, which placed short-term pressure on the market demand. As an enterprise with a global footprint, PAX implements risk control measures primarily involving client payments are settled in US dollars across different markets, to manage business and financial risks effectively. In response to the strong US dollar and high interest rates, factors which could impact on the timeliness of client payment settlements, the Group has introduced a more stringent credit management strategy for shipments.

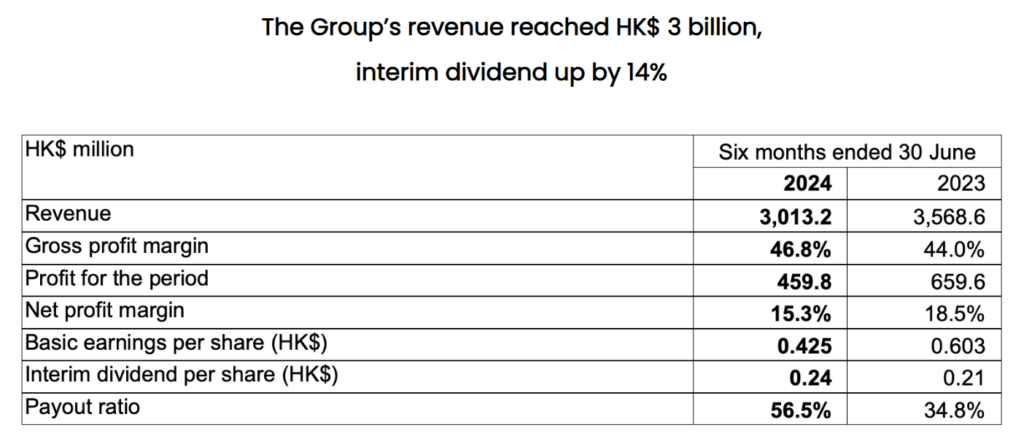

During the period, the Group recorded revenue of HK$3,013.2 million, of which sales of Android smart terminals accounted for over 50%, with an increased gross profit margin of 46.8%. PAX continued to achieve profitable performance, with profit for the period of HK$459.8 million and net profit margin of 15.3%. The board of directors has resolved to declare an interim dividend of HK$0.24 per ordinary share for the six months ended 30 June 2024.

PAX Smart Terminals Industrial Park commenced operations in early 2024

In early 2024, PAX Smart Terminals Industrial Park in Huizhou (China) commenced operations, it will help optimise supply chain efficiency and reinforce our delivery capabilities. The capital expenditure (including the cost of land use rights) of the industrial park was approximately HK$760 million. This state-of-the-art industrial park features modern production lines, R&D laboratories, engineering labs, testing centers and well-equipped dormitories for personnel, covering a total gross floor area of approximately 261,000 square meters.

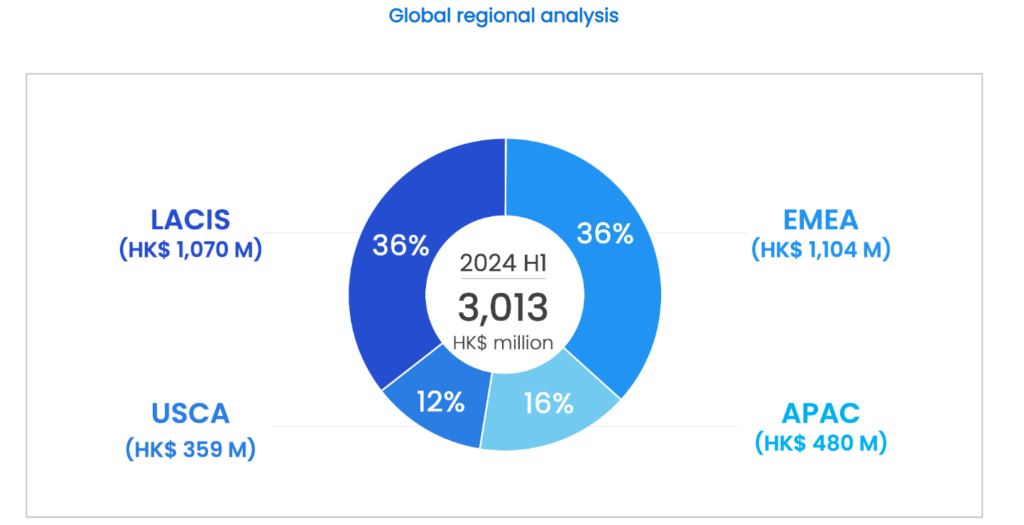

Europe, the Middle East and Africa (EMEA)

The Group’s largest revenue contribution during the first half of 2024 came from Europe, the Middle East and Africa. PAX business remained strong across European markets, with considerable sales contribution coming from Italy, the United Kingdom and Hungary, despite fluctuating demand in Germany and Spain. Our flagship model A920Pro continues to enjoy widespread popularity across the entire region.

With the European Union’s Alternative Fuels Infrastructure Regulation (AFIR) coming into effect in April 2024, the payment landscape for EV charging stations is evolving rapidly. Our unattended payment terminal models IM15, IM20, IM25 and IM30 all enable seamless integration with the existing EV charging infrastructure, supporting diverse payment options and operating systems.

In the Middle East, the Group’s sales in Saudi Arabia resumed an upward trend, while exchange rate volatility in Africa continued to pose challenges for our customers. Recognizing the vast market potential in the Middle East and Africa, PAX continues to work closely with local partners to optimize product offerings for local market needs.

Latin America and the Commonwealth of Independent States (LACIS)

During the period, the slowdown of sales in Brazil offset strong growth experienced in other markets within the region. In Brazil, interest rate fluctuation and a conservative economic landscape have led to a slowdown in economic growth. Coupled with the high installed payment terminals in the country, the market demand has slowed down.

In other South American countries, Mexico and Argentina have emerged as strong drivers in the region. PAX has achieved positive breakthroughs in its local sales channel expansion, with the certification process involving channel partners and PSPs progressing steadily. In Mexico, PAX IM30 has been increasingly adopted by local vending machine operators, airline and public transit system, further strengthening its presence in the self-service and transportation sectors.

Asia Pacific Region (APAC)

In the Asia Pacific region, driven by innovative products and increasing PAX brand recognition, the Group has further strengthened its market share and achieved considerable growth in multiple markets.

In India, the Group continues to maintain market leadership as the preferred supplier by major banks and PSPs. In the first half of 2024, PAX sales in India showed a recovery trend, fueling growth for the Asia Pacific region.

In Japan, PAX achieved noteworthy channel expansion, making the country one of our key markets in the region. The Group has been enhancing the deployment of its smart payment terminals to wider application segments. Notably the A920 SmartPOS model has been increasingly adopted by more Japanese acquiring institutions, recognised for its high performance and excellent user experience. The next-generation smart terminal A920MAX will soon be launched in Japan and is expected to spark a new wave of market enthusiasm.

Across the Southeast Asia, the Group recorded considerable sales in Indonesia, the Philippines and Thailand. In Australia and New Zealand, PAX successfully extended its reach to more PSPs. With a strong market appetite for Android payment terminals in the Australian and New Zealand markets, the Group will devote more resources in accelerating Android product deployment and enhancing localized support and services.

The United States of America and Canada (USCA)

In North America, high interest rates continue to pose significant challenges for retailers. In the first half of 2024, a number of major retail chains opted to strategically close down brick-and-mortar stores across the country. As a result, many independent sales organizations (“ISOs”) and financial institutions have slowed down their deployment of payment terminals, which in turn impacted PAX sales in North America.

In response to the demand for value-added services in the retail and hospitality segments, the Group introduced the Elys Series of Android EPOS solutions to North American clients. In the first half of 2024, the Elys Series L1400 dual-screen terminal received positive market feedback. PAX will devote more resources in strengthening EPOS sales channels and working closely with independent software vendors (ISVs) to deliver more tailored solutions for this new market segment.

Mr. Jack LU, Chief Executive Officer of PAX, commented, “As consumer and merchant demand for electronic payment solutions is evolving far beyond mere transactional services, Android smart payment terminals are emerging as more effective payment solutions that better fulfil market needs. By capitalizing on our expertise in Android smart payment terminal technology, PAX is dedicated to offering a wider product portfolio for all merchant segments, as well as ongoing innovation in SaaS solutions.”